Mental Health and Personal Finance

Research suggests that one in four people with mental health problems are in debt, while one in two people in debt have a mental health problem.

David Hayes is an Honorary Research Fellow in the Personal Finance Research Centre (PFRC) and is a member of the All-Party Parliamentary Group (APPG) on Mental Health and Debt. His primary fields of research include the links between mental wellbeing and debt, financial education, and the financial and wider wellbeing and quality of life among the older population. Prof Sharon Collard is Research Director and Professor of Personal Finance at PFRC. She has conducted extensive research on financial inclusion, consumer credit use and problem debt, and financial capability.

A key conclusion from PFRC’s work, evidenced in the ESRC project ‘Financial dimensions of wellbeing in older age’ (ES/K004263/1) is that older people who are struggling to manage their finances are eight times more likely to have reduced levels of mental wellbeing.

The International Longevity Centre (ILC-UK) are the leading think-tank on ageing and demographic change and have worked with PFRC extensively, on research outputs and high-level policy documents such as Government White Papers.

Together they won ESRC IAA Exploratory funding to form a steering group of influential stakeholders to direct future research and collaborations, with contributors ranging from Members of both the House of Lords and the House of Commons and senior academics to third sector organisations such as Age UK and Citizens Advice. The groups also included policymakers, think-tanks and NGOs representing a range of issues concerning the older population.

Two areas they were particularly interested in were the causality of links between mental and financial wellbeing, and the ways in which existing data, findings and approaches could be used to benefit both the stakeholder organisations and people suffering from the twin problems of poor mental wellbeing and debt.

One of the project’s intended outcomes was to feed directly into the APPG, with plans to inform both Party manifestos and priorities for other stakeholder organisations such as the NHS, as well as providing direct input to government white papers.

The project successfully established this key group, with many of these key policy influencers in mental health and finance brought together for the first time.

Discussions focused on the practical and pragmatic. There was an overarching commitment to ‘joining the dots’ and improving the poor links between debt advice services and mental health services. They also decided to focus less on whether poor mental health equates to poor financial management or vice versa, and instead on how the relationship could be addressed and the situation improved. It was agreed that they needed to draw a distinction between mental health and mental ill health (as a psychiatric diagnosis), and that to be effective, focus should probably be narrowed to debt as opposed to financial wellbeing.

They further agreed that bespoke approaches would be more effective in bringing organisations together, rather than politically driven over-arching ‘publicity’ events. And that there was huge potential in exploring secondary datasets to draw out useful information.

The IAA seminar series helped increase PFRC’s profile in this area and paved the way for the centre to develop its programme of work around customers in vulnerable situations, which included funding from the Finance & Leasing Association (FLA) and the UK Cards Association (now part of UK Finance) for a large-scale research study to help their members identify and support customers in vulnerable circumstances. A further development was a successful bid for further ESRC IAA funding for a full-scale Impact project to take the work forward through 2017 and 2018.

The earlier project had shown there was little interaction between the relevant sectors, and consequently minimal knowledge exchange. The new project expanded the expert group into a larger network, helped by a high-profile Seminar series, informed by a Policy Briefing and practical guidance.

Three successful and well-attended seminars brought together over 100 experts from different fields and disciplines. They included health practitioners, academics, financial services organisations, the debt and money advice sector, campaigners for people in vulnerable situations – including those with lived experiences, as well as regulators and commercial organisations in related sectors such as utilities.

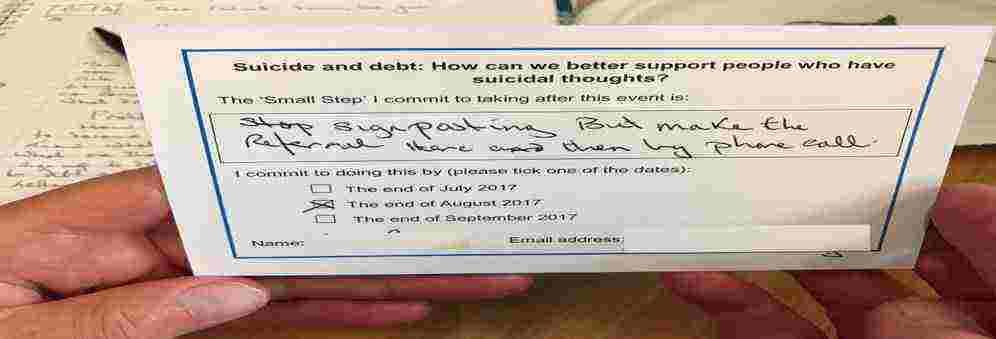

Two of the seminars used ‘commitment cards’ to encourage further action by participants. When the project team followed up, a significant proportion had made practical changes in their own practice or that of their organisation, based on the seminar. For example, Monzo, a digital online bank, subsequently added a new feature to its app, enabling users to self-exclude from gambling sites.

The Seminar booklet produced sets out clearly the types of practical actions that organisations can take, along with links to further information and case studies. In addition, the team also met more confidentially with stakeholders who had not attended the seminars, such as financial services firms and utilities providers, and the UK Finance’s Vulnerability Group representing large banks and lenders.

David reported that “these outcomes could not have been delivered without the IAA funding. The project has put us in touch with potential future funders and collaborators, helping us and others to form new links and share expertise across third sector, local government and public health organisations.”

ILC UK added “We greatly valued our involvement in the IAA seminar series and conversations have continued long after it concluded. The questions posed have also informed our thinking and discussions with key stakeholders. Through the series we also encountered innovators and entrepreneurs who we have subsequently encouraged [to explore] solutions to the challenges faced by vulnerable consumers.”